Looking for Tata AIG Travel Insurance Plan Let You Travel? Read this post and plan your travel safely.

Introduction

Travel is the easiest way to explore the wonders of the world. You may head out on holiday with your friends or loved ones. You may even head out to attend international conferences related to your work. Irrespective of the reason, every one of us wants to experience a hassle-free trip. However, problems may come anytime during your journey.

For instance, somebody may steal your passport; you may lose your luggage, or experience a delay, which may cause missed transit flight. Dealing with such problems is a financially and emotionally challenging tasks. Hence, you have to get the right Tata AIG travel insurance plan to look after you and other fellow travelers while traveling locally or abroad.

Scope of Tata AIG Travel Insurance Policy

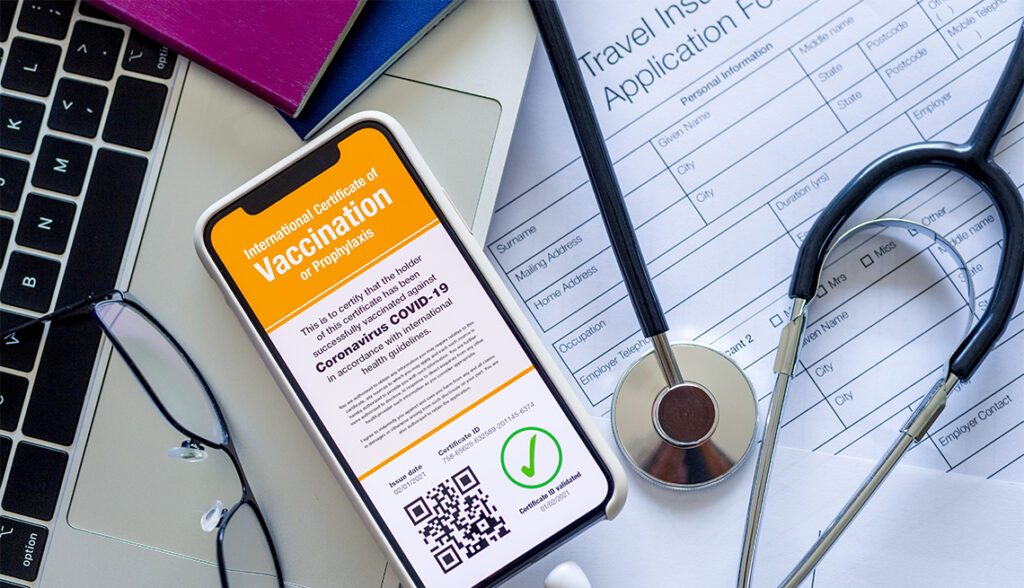

Covid-19 Coverage Plans

Sickness and Accident Medical Expense

Insured individuals will get compensation for their incurred expenses if they are diagnosed with Covid-19 during the trip. Moreover, Tata AIG travel insurance will cover tourists if they have to admit to the hospital outside of India for Covid-19. The policy will cover you against medical expenses to certain limits highlighted in its schedule.

Cancellation of the Trip

If the insured person tested Covid-19 before commencing the international trip, the respective person/people will receive the compensation benefit. The benefit associated with the cancellation of the trip covers any of the immediate family members. It also covers the travel companion of the policyholder diagnosed with Covid-19 as well.

The insurance policy will reimburse the policyholders by providing the non-refundable and unused amounts of their previous bookings, like the cost of tickets, and hotel booking cost. However, you may avail of the trip cancellation-related benefits only if you pay the premium amount and book such services before going for the Covid-19 test.

Interruption or Trip Curtailment Benefits

Many times, you or your travel companion are forced to curtail the trip due to Covid-19 positive results. In this situation, the Tata AIG travel insurance provider will reimburse the expenses related to interruption in your trip. Here, the expenses covered by the plan are inclusive of pre-paid parts of your tourism and accommodation expenses. These expenses are non-refundable and incur extra accommodations. These are travel expenses incurred from the interruption in your trip and are subject to the limit of the insured sum.

Automatic Extension

Tata AIG extends its travel insurance automatically for 7 days if a lockdown is there in your destination country. However, the extension will be invalid if you get an alternative transportation mode to return to your native country.

Medical Coverage Plans

Medical Plans to Handle Emergencies

Accidents and sickness while traveling abroad are nightmares leading to expenses. Luckily, with an international travel insurance policy by TATA AIG Group, you may handle financial implications, which may arise with falling sick or an accident while you are abroad. The policy covers everything, like illness with hospitalization, dental emergencies, orthopaedic emergencies, and fatalities. Policyholders may change the insured sum according to their requirements. Furthermore, you get help from Tata AIG if you are in an abroad hospital and your medical emergency plan expires. Accordingly, the plan covers for a maximum of 60 days or up to the discharge date, whichever occurs early.

Medical Evacuation

Travel and tourism involve viewing scenic beauty and exploring landscapes and unique cultures often far from urban civilization. However, along with the excitement associated with visiting incredible places, greeneries, and high mountains, you may experience medical emergencies at any point of your journey. Here comes the role of medical coverage by Tata AIG travel insurance plan for international tourists. The policy will take care of you with medical evacuation to handle emergencies. Alternatively, you may benefit from an overseas travel insurance plan if you have to evacuate and return to India for your medical treatment.

Repatriation and Accidental Death

Any medical emergency or severe accident while traveling abroad may end up with fatalities. In this situation, an international travel insurance plan by Tata AIG will provide the full-insured sum amount to your nominee. Simultaneously, the policy will take care of the repatriation cost of the demised person back to India.

Baggage Covers included in Travel Insurance

Delay in Baggage

If misdirection or delay to your checked-in-baggage occurs, the travel insurance will reimburse you. The amount will cover the expenses associated with personal items to let you continue your trip smoothly.

Baggage Loss

If your checked baggage losses due to misdirection from a common carrier, non-delivery at your chosen destination, or theft, you get the compensation associated with your lost belongings. The rule is applicable if you lose your complete baggage instead of partial damage or loss of your belongings.

Travel Coverage

Loss of Passport

The insurance provider will compensate the reasonable expense if you lose or someone steals your passport. Simultaneously, the company will contact the authorities to provide you with a duplicate one in no time.

Cancellation of Trip

Do you or your travel companion and the family members have to cancel the trip because of injury, sickness, or death? The travel insurance plan will pay for the loss of the amount you deposit while buying the policy.

Missed Flights

Many times, you may miss the connecting flights or departure because of equipment failure or bad weather. In this situation, you should get an international travel insurance plan to handle additional expenses while returning to your home.

Delay in Flights

Delay in flights is a stressful experience for travelers. In some cases, delays lead to delay of forwarding plans followed by a huge financial loss. Local strike or bad weather often delays a flight by approximately 12 hours to 15 hours. In this situation, you have to book a temporary night stay at a nearby hotel and bear extra expenses. Tata AIG travel insurance for international travelers covers the respective expenses if flight delays take place.

Hijack Allowance

Tata AIG travel insurance will provide you distress allowance if the flight, in which you are traveling suffers hijack.

Conclusion

Traveling to foreign countries gives us a pool of opportunities to relive history and explore everything we have heard and learned in books. Moreover, tourism gives the unique ability to get a glimpse of many myriad cultures and enjoy tasty cuisines. Besides reading e-books, books, and magazines, travel is the best mode to educate ourselves. Therefore, whether you travel frequently or occasionally, for work or leisure, get a Tata AIG travel insurance plan. With the right policy, you expect to enjoy the sights safely without bothering about your small stuff.